Financial Accountability: A Citizen's Guide to the PGCPS 2023 CAFR

In public finance, the "shareholders" aren't investors seeking a profit; they are the citizens and the elected officials who fund and oversee the institution. For an organization like the Prince George's County Public Schools (PGCPS), understanding their publicly available financial information, specifically the 2023 Comprehensive Annual Financial Report (CAFR) is essential for holding it accountable. This report, distinct from corporate statements, tells a story of stewardship over public resources.

The Public Entity and Its Reporting Mandate

Photo Credit: Canva

PGCPS is a large-scale governmental entity, not a commercial one. Its core purpose is the delivery of public education and related services to the community. Consequently, its financial reporting adheres to the rules set by the Governmental Accounting Standards Board (GASB), producing the CAFR. This report is the official record used to demonstrate to the public how taxpayer money was spent.

The key financial statements within the CAFR that we examine are the government-wide statements, which use the accrual basis to offer a complete financial picture, including long-term debt and assets (Bettner, 2018).

External Stakeholders: The Taxpayer and Local Government

Photo Credit: Canva

The combined interests of the citizenry (taxpayers) and the local government (County Council) form the most critical external stakeholder group for PGCPS. Their primary concerns are:

Fiscal Prudence and Efficiency: Are funds being spent wisely and achieving desired educational outcomes?

Long-Term Solvency: Can the school system meet its ongoing financial obligations, including deferred maintenance and employee retirement liabilities, without jeopardizing future service delivery?

This group relies on the CAFR to inform major decisions, such as voting on bond measures, approving the annual budget, and setting local tax rates.

Key Financial Information and Conclusions Drawn

External stakeholders focus their analysis on specific metrics to assess both the current and future health of the school system.

Assessing Financial Position: The Statement of Net Position

This statement, analogous to a corporate balance sheet, is where users gauge PGCPS’s long-term health by analyzing the Net Position (assets minus liabilities):

Unrestricted Net Position: This figure represents the resources the system has available to meet its obligations and fund future activities without being legally constrained.

Conclusion: A growing or stable positive unrestricted net position suggests the system is financially sustainable. Conversely, a consistently negative net position (especially after adjusting for capital assets) signals that the system relies on future taxpayers to cover existing obligations, raising concerns about long-term solvency (GASB, 2023).

Evaluating Operational Funding: The Statement of Activities

This statement reveals the true cost of providing educational services versus the revenue generated to cover those costs:

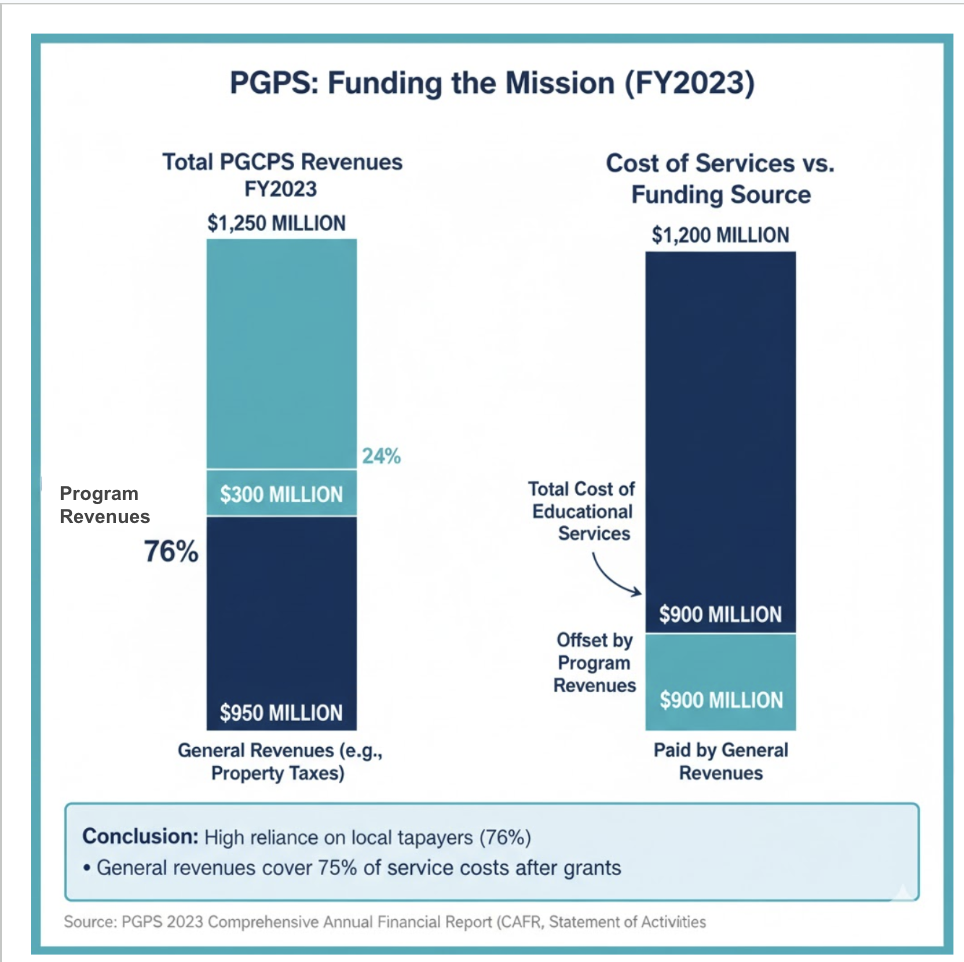

Program Revenue vs. General Revenue: Stakeholders compare the direct revenue from specific programs (e.g., federal grants) against the cost of those programs. They also track the system’s reliance on general revenues (local property taxes).

Conclusion: If the general revenues disproportionately subsidize the cost of core programs, it indicates a high dependence on local taxpayers. Citizens evaluate whether the cost of education per pupil is justified by the outcomes and comparable to other districts.

Canva

Ensuring Short-Term Liquidity: The Governmental Funds

Canva

Our Position: Within the Target!

The General Fund Balance is the most closely watched metric for current financial flexibility:

Unassigned Fund Balance: This shows the liquid resources available for immediate, unplanned needs. Local governments often target a fund balance of 5% to 15% of general fund expenditures as a safety cushion.

Conclusion: A healthy fund balance, say 1.16% of expenditures, provides a necessary buffer against revenue shocks or unexpected costs (Bettner, 2018). A balance that is too low signals operational risk; one that is excessively high may suggest that the county is overtaxing its citizens.

In essence, the PGCPS CAFR allows taxpayers and their representatives to move beyond rhetoric and ground their policy decisions in verifiable financial reality. By analyzing these key statements, they ensure that the massive public investment in education is managed with both efficiency and integrity.

References:

Bettner, M. S. (2018). Introduction to Financial Accounting. Boston: ACE Publishing.

Governmental Accounting Standards Board (GASB). (2023). Codification of Governmental Accounting and Financial Reporting Standards. Norwalk, CT: Author.

Prince George's County Public Schools (PGCPS). (2023). Comprehensive Annual Financial Report for the Fiscal Year Ended June 30, 2023. Retrieved from

https://www.pgcps.org/globalassets/offices/financial-services/docs---financial-services/comprehensive-annual-financial-reports/annual-comprehensive-financial-

report-fy2023.pdf